Bonus Depreciation 2025 Rules. Bonus depreciation is a type of tax deduction that has been updated for a short period of time to cover the entire cost of specific expenses, purchases, and investments. Starting on january 1 st, 2025, for assets placed in service during the following periods, the bonus depreciation.

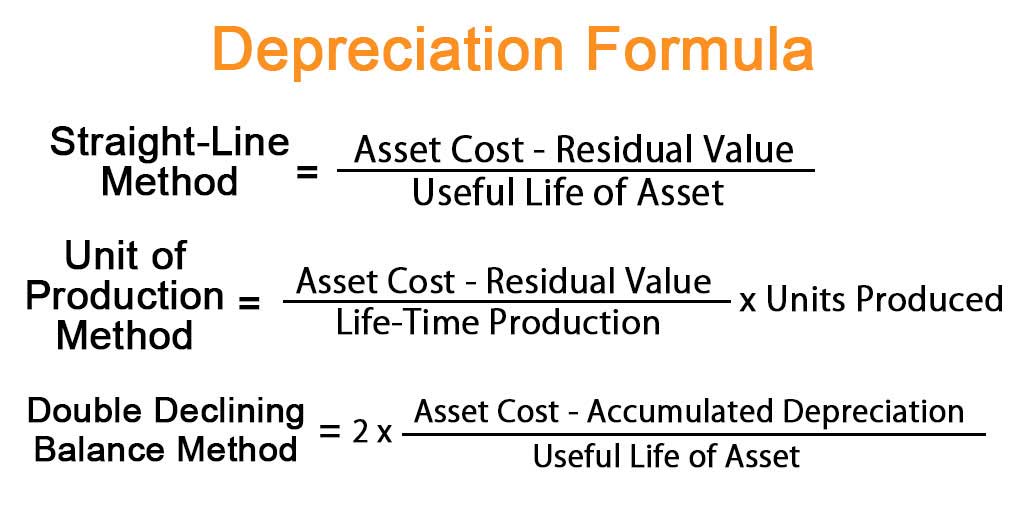

Bonus depreciation is a valuable tax incentive that allows businesses to deduct a significant portion of the cost of eligible assets upfront, rather than writing them off incrementally. It allows a business to write off more of the cost of an asset in the year the company starts using it.

2025 Bonus Depreciation Limit Ilene Adrianne, For vehicles under 6,000 pounds in the tax year 2025, section 179 allows for a maximum deduction of $12,200 and bonus depreciation allows for a maximum of $8,000, for a total.

Bonus Depreciation Rules For 2025 Cyndi Valida, It allows a business to write off more of the cost of an asset in the year the company starts using it.

Depreciation Rules For 2025 alma octavia, Starting on january 1 st, 2025, for assets placed in service during the following periods, the bonus depreciation.

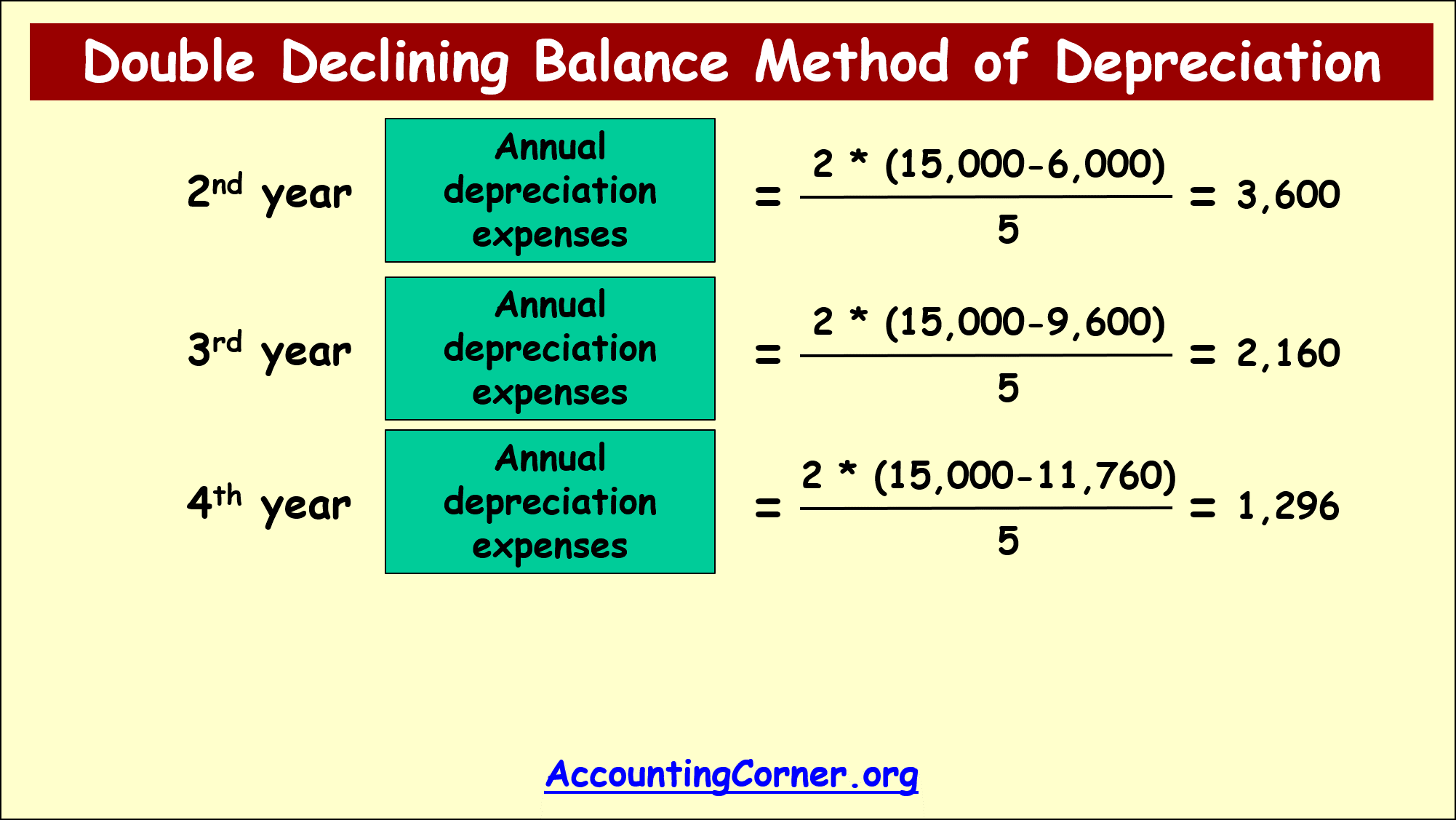

2025 Depreciation Rules Cleo Paulita, For 2025, the bonus depreciation percentage is set at 80%, which means you can write off 80% of the cost of eligible new or used equipment immediately.

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

2025 Bonus Depreciation Rules 2025 Tessi Marnie, Earnings before interest, taxes, depreciation and amortisation (ebitda) grew by 10.8% in fy24 at rs 11,554 crore over rs 10,426 crore in fy23, the group said in a statement on.

2025 Bonus Depreciation For Vehicles Caryn Cthrine, Bonus depreciation deduction for 2025 and 2025.

2025 Depreciation Rules Cleo Paulita, For 2025, the section 179 expense deduction is capped at $1,050,000, and the total amount of equipment purchased cannot exceed $2,620,000.

2025 Vehicle Bonus Depreciation Debi Mollie, Starting on january 1 st, 2025, for assets placed in service during the following periods, the bonus depreciation.

2025 Bonus Depreciation For Vehicles Caryn Cthrine, In 2025, bonus depreciation continues to be a valuable tool for businesses looking to invest in new or used property, offering a deduction of a certain percentage of the asset’s cost.

Calendar 2025 Malayalam August. This page provides malayalam calendar with august 17, 2025 detailed malayalam panchangam for thiruvananthapuram, kerala, india.[...]

Solar Eclipse 2025 Map Kentucky. On that date, millions of people across the united states will see a rare. Updated[...]

Map Scores By Grade Level 2025 Texas. Statewide summary reports for all test administrations can be found in the research[...]